osceola county property taxes due

The exact property tax levied depends on the county in Michigan the property is located in. Polk County Stats for Property Taxes Looking for more property tax statistics in your area.

St Cloud Chamber Of Commerce Homestead Exemption Press Release Osceola County Property Appraiser Exemptions And Covid 19 Kissimmee Florida February 18 2021 Osceola County Property Appraiser Katrina Scarborough Encourages Osceola County

Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax of 28400 046 of median home value per year.

. Instantly view essential data points on Polk County as well as FL effective tax rates median real estate taxes paid home values income levels and even homeownership rates. Ad Make Sure Youre Charging The Right Tax Rate On Your Rental Home. The exact property tax levied depends on the county in Virginia the property is located in.

Washtenaw County collects the highest property tax in Michigan levying an average of 391300 181 of median home value yearly in property taxes while Luce County has the lowest property tax in the state collecting an average tax of 73900 086 of median home value per year. Ad Make Sure Youre Charging The Right Tax Rate On Your Rental Home.

Percent Of Households On Food Stamps By U S County Vivid Maps Stamp Map Cattle

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser Osceola County Scarborough Osceola

Osceola County Property Appraiser How To Check Your Property S Value

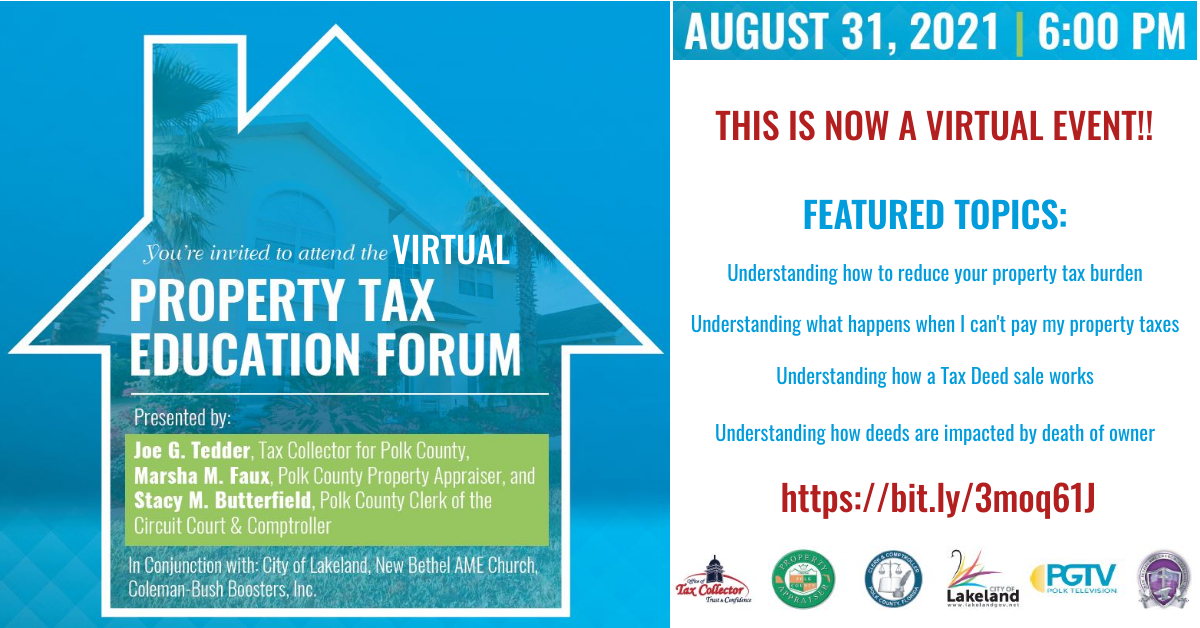

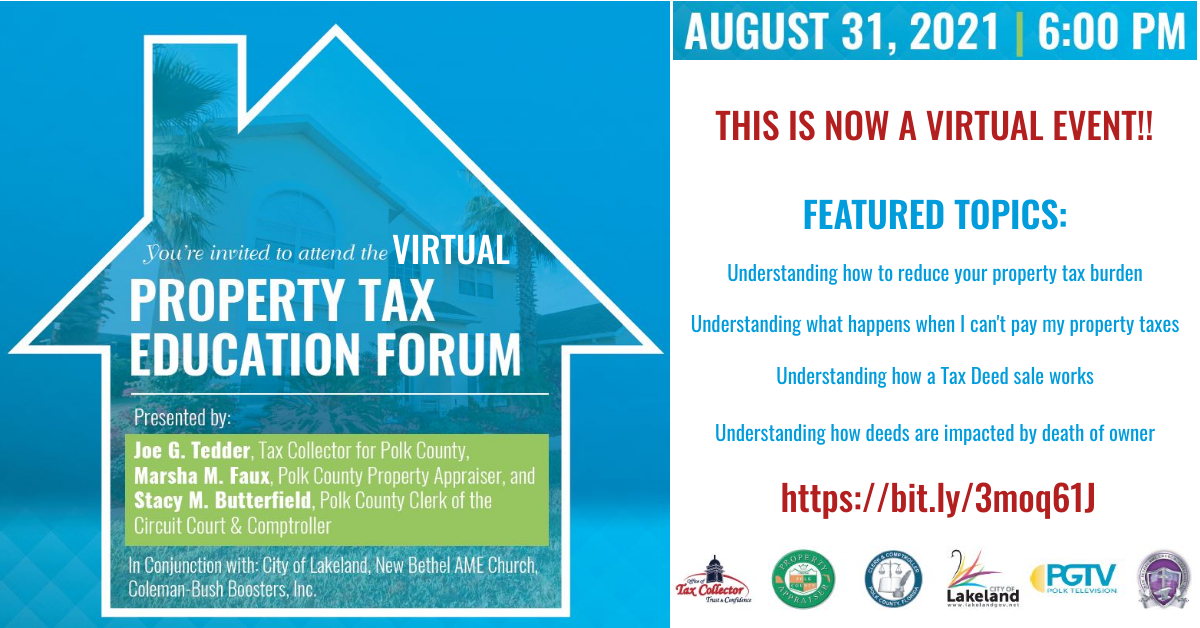

Polk County Constitutional Officers Present A Virtual Property Tax Education Forum Polk County Tax Collector

Ayment Ptions Osceola County Tax Collector

Property Tax Search Taxsys Osceola County Tax Collector

Problemas Invisibles En Un Fixer Upper 12 Signos 6 De Febrero De 2020 Tal Como Esta As Is En La Descri Real Estate Advice Real Estate Building An Empire